Everything about "Navigating the Complexities of Refundable Tax Credits Made Easy"

Refunds Redefined: The Benefits and Limitations of Refundable Tax Credits

Tax time can be a taxing time for numerous people and businesses. The method of filing taxes, calculating rebates, and determining the amount owed or reimbursement can be very daunting. Nonetheless, understanding the different tax credit histories offered can easily help minimize some of that worry. In particular, refundable tax obligation credit ratings use a one-of-a-kind advantage to taxpayers by giving prospective refunds even if they possess no income tax obligation. In this write-up, we will certainly look into the advantages and restrictions of refundable tax obligation credit ratings.

Just before delving in to the complexities of refundable tax credit reports, it is crucial to know the distinction between refundable and non-refundable tax credit reports. Non-refundable tax credit histories can reduce an person's or business's overall tax responsibility to zero but maynot lead in a reimbursement if the credit rating goes beyond the amount been obligated to repay. On the other palm, refundable tax obligation credits not just may minimize or get rid of taxes been obligated to pay but additionally deliver refunds beyond any type of superior responsibility.

One considerable advantage of refundable income tax credit histories is their ability to offer economic assistance to low-income people and families who might have little bit of or no income tax responsibility. These individuals may still encounter notable financial burdens such as childcare expenditures or healthcare expense. By using reimbursements with refundable tax obligation credits, federal governments strive to lessen some of these economic obstacle.

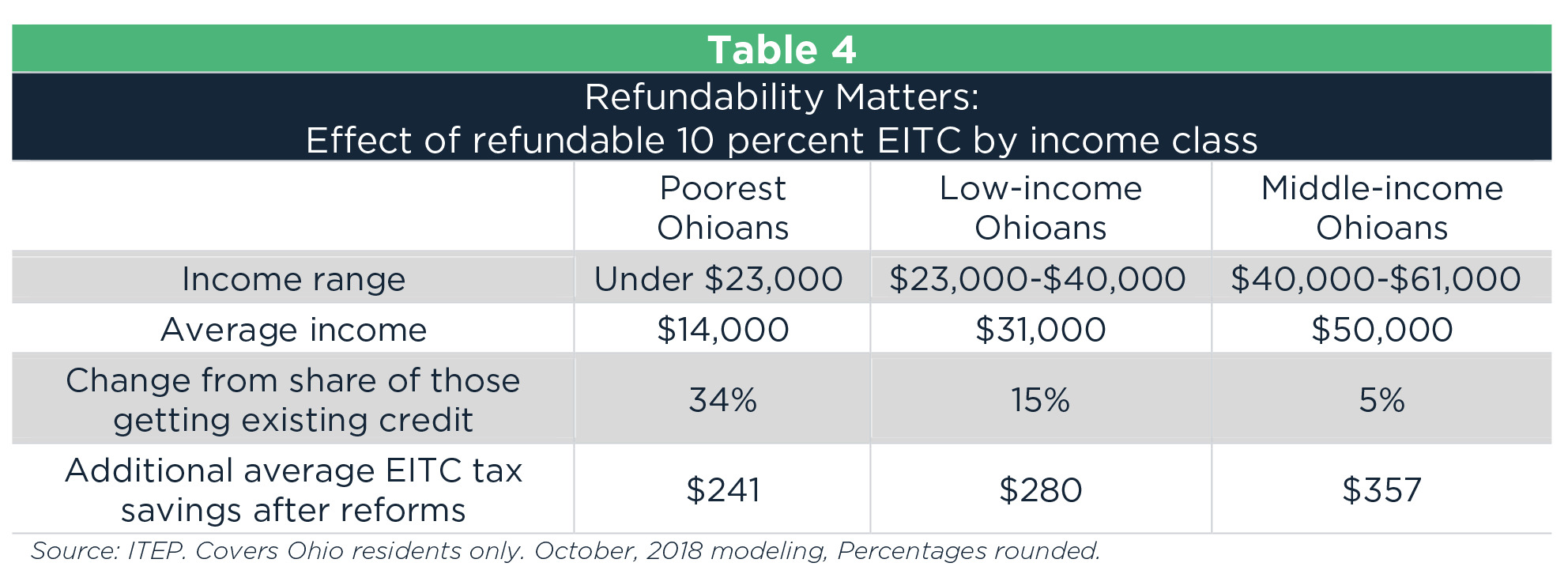

For example, in the United States, the Earned Income Tax Credit (EITC) is one such refundable credit score that gain low- to moderate-income working individuals and households. The EITC delivers a economic boost by minimizing income taxes been obligated to pay while likely leading in a significant refund for qualified taxpayers. This credit scores not simply helps elevate people out of poverty but also induces economic development by raising customer costs power.

Yet another advantage of refundable tax credits is their possible beneficial impact on education and medical care affordability. Several nations supply education-related tax obligation benefits that are partially or completely refundable. Such reimbursements may assist balanced out the expense of university tuition, textbooks, and other informative expenditures. In Read More Here , refundable medical care income tax credit scores can create health and wellness insurance coverage fees extra affordable for individuals and households.

Despite their perks, refundable tax obligation credits additionally have limits that need to have to be looked at. One limitation is the complexity of determining qualifications and calculating the credit rating volume. Eligibility criteria may vary based on revenue degree, filing condition, amount of dependents, and various other factors. This complexity can easily lead to confusion for citizens and might demand professional assistance or comprehensive research study to ensure correct calculations.

In addition, refundable tax credit scores can easily potentially be subject to misuse or fraudulence. Due to their financial value and accessibility as refunds, these debts might bring in deceitful claims or attempts to exploit technicalities in eligibility criteria. Consequently, federal governments must apply strict proof processes and penalties for illegal case to keep the stability of refundable tax obligation credit scores systems.

Lastly, it is important to take note that refundable income tax credit reports are commonly subject to changes in regulation or authorities plans. As these credit ratings are designed to address details socio-economic problem or market certain behaviors (such as energy-efficient techniques), they may be revised or stopped over opportunity. Citizens counting on these credits need to stay informed regarding any kind of potential modifications that could possibly affect their qualification or volume of reimbursement.

In conclusion, refundable tax credits play a essential duty in providing monetary help and attending to economic disparities for low-income people and households. These credit ratings provide advantages such as potential refunds beyond any kind of impressive responsibility while helping stimulate economic growth with raised individual investing power. However, they likewise come with limits such as complication in establishing eligibility and sensitivity to abuse or fraudulence. It is critical for citizens to know the advantages and restrictions of refundable tax obligation credit ratings while properly navigating the ever-changing yard of taxes plans.

Word matter: 800